2023 stood out for numerous reasons, and at Kent, our multifamily team in Dallas, TX was fully engaged in preparing for one of our most significant projects yet: One Rangers Way. Nearly 6 months later, we’re sharing the full story of this 299-unit complex, including the iconic v-columns, told by […]

Read More

Tucked between the Amway Grand Plaza Hotel and DeVos Place, Kent Companies’ crew has been (literally) laying the foundation for a vibrant gathering spot in the heart of downtown Grand Rapids. Lyon Square is the first in a series of park and trail improvements planned for the Grand River. The […]

Read More

The construction industry is creating over 168,000 new jobs each year. How will the industry fulfill this growth? Women in Construction (WIC) Week is one answer. WIC Week is a national initiative that highlights women who excel in construction and opens doors to more individuals to join the industry. While […]

Read More

Tucked away on the Thornapple River in Michigan is the City of Hastings, a vibrant community with quaint shops and unique restaurants. Located in the heart of Barry County, this small town is getting a facelift after nearly 30 years. Kent Companies and Katerburg Verhage are working together to […]

Read More

At the heart of every team are individuals whose dedication is a beacon leading collective success. At Kent Companies, the Fall 2023 Honor Coin recipients stand as pillars of commitment to our Four Hallmarks – Safety, Productivity, Quality, and Customer Service. Read on as we unveil the stories behind these […]

Read More

Every Good Story Starts with a Beer—and Even Better Flooring Solutions Founded in 2014, the Detroit HopCat quickly became a landmark community watering hole. Its central location—an easy stroll to Little Caesars Arena, Comerica Park, and Ford Field—and extensive array of taps have enticed locals through the front door for […]

Read More

For years the West Coast was the primary hub for imports but over the past several years we’ve seen a significant shift. All this to say, distribution companies have evaluated alternative import solutions and are rapidly investing in the Southeast for a better supply-chain network. No one understands this shift […]

Read More

It’s not often that a movie sequel lives up to the hype of the first installment. Fortunately for Kent Companies, we keep getting better with every new chapter, and our highlight reel at Studio Park in downtown Grand Rapids proves just that. 2023 marks the topping out of Studio Park […]

Read More

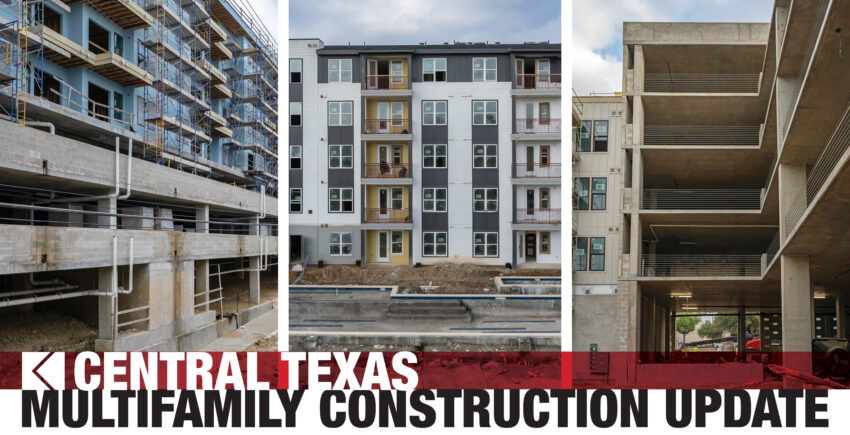

In metro areas across the country, real estate commands a premium. But you know what else does? Adequate parking. In Central Texas, the demand for residential communities is soaring, and that’s why our Austin multifamily team is a go-to partner on three projects going up in East Austin; Millenium Eastside […]

Read MoreFacilities managers use wintertime strategically. It’s a smart time for construction because it can be an off-season for some trade contractors. While lower demand can set the stage for projects to move faster, winter construction projects require special planning and strategy. Freezing temperatures bring a host of additional considerations for […]

Read More